-90%

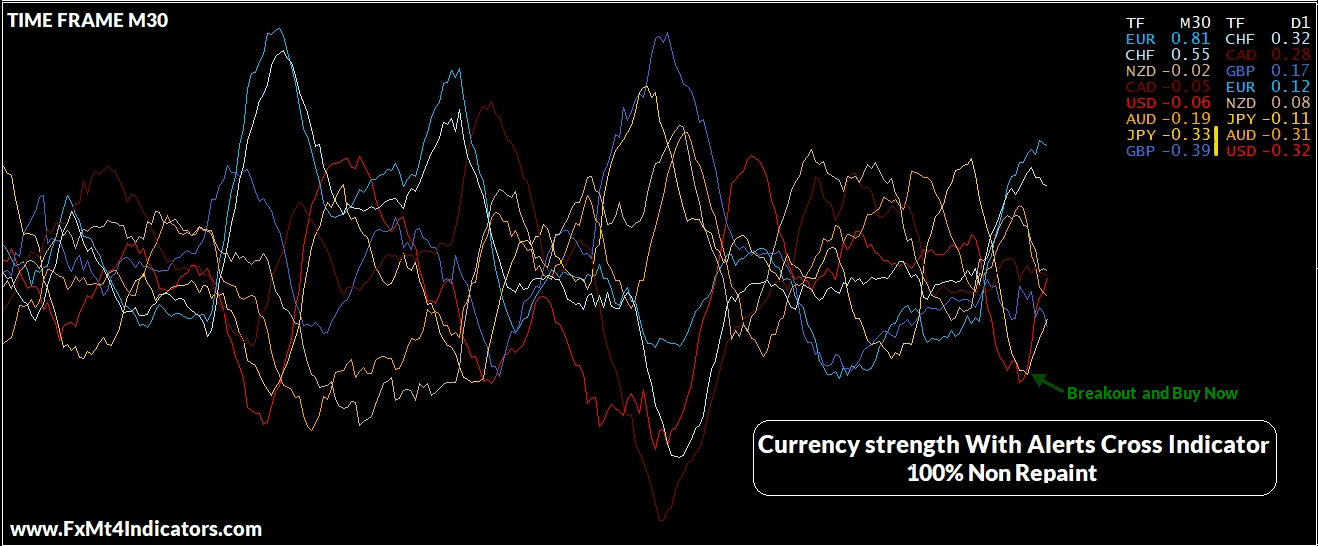

Currency strength With Alerts Cross Indicator

Original price was: ₹96,000.00.₹9,900.00Current price is: ₹9,900.00.

-

Original Indicator

-

Currency pair: All

-

100% Non-Repaint

-

Platform : Meta trader 4

-

Trading time: Every time

-

Timeframe: All

-

Instant Download in Zip file

-

All Currency Pairs in one chart

-

Lifetime license with unlimited Pc/Laptop

-

Type of strategy: Scalping and short term or Long term

-

Recommended Broker: ICMARKET EXNESS

-

If you have any questions please contact : FxMt4Indicators@gmail.com And Telegram @FxMt4Indicators